Better Data, Better Insight, Lower Cost

NICE Satmetrix B2B Benchmarks from Real Decision-Makers

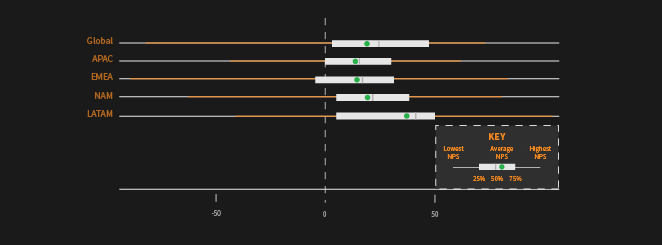

© 2015 NICE Satmetrix Systems, Inc., Global and regional average Net Promoter Scores for B2B companies

Poor Quality, High Price

The scarcity of high-level decision-makers gives rise to a range of problems with traditional B2B market research panels. First, even when panels can get responses, influence over a relationship is self-reported, and very difficult to verify.

Additionally, while decision makers have an incentive to let their vendors know how they feel about a relationship, there’s little utility in them doing the same for a third-party research study. In some cases they may be contractually prevented from doing so.

B2B studies are often incredibly expensive, and based on small samples of uncertain quality.

And finally, overcoming these challenges drives up the cost; B2B responses to research surveys can cost from tens to hundreds of times more than those from consumers. These things combined mean that B2B studies are often incredibly expensive, and based on small samples of uncertain quality.

Different Approach, Better Data

The NICE Satmetrix approach is different — we use data collected directly from clients who participate in our normative research program.

This means that the responses come directly from companies’ own relationship NPS programs, and that respondents come directly from companies’ customer lists. Not only are they known to be real customers, they’re the people it’s most important to hear from, too. It also means that our database is based on many million responses, instead of a few thousand.

A Global Perspective

Because of the sheer volume of data available, NICE Satmetrix benchmarks are not limited to a single country. Being able to see how performance varies by geography is an important feature — like any psychometric measure, the Net Promoter Score is subject to some cultural variation in response norms.

The Catch

There is of course a snag, and it’s that participation is entirely anonymous. Our consumer NPS benchmarks list participating companies by name and give a rank. But in our B2B benchmarks, we don’t name names. Rather, we provide a summary of the Net Promoter Scores that we see in particular industries in particular parts of the world. So you can see averages globally, by region, and by country, and even look at scores for different percentiles.

Get Insights and Get Planning

Reports are available for different industries; just as in our consumer research, we see significant variation by sector. Our B2B benchmarks (available as part of Premium membership in the Net Promoter Network, or here [link to SMX page]) allow you to set meaningful targets by region, and even contain data and instructions for you to create your own custom benchmarks for internal geographies and regions. It’s never too soon to get the insight you need to plan for your program’s success.