The Art of Positioning

Is That Service Really Better, or Does It Just Have Better marketing?

Our consumer NPS studies have some great examples of how companies offering a simple, pro-customer value proposition can do exceptionally well in the rankings — often while offering essentially the same product as their competitors.

Same Service, Different Satisfaction

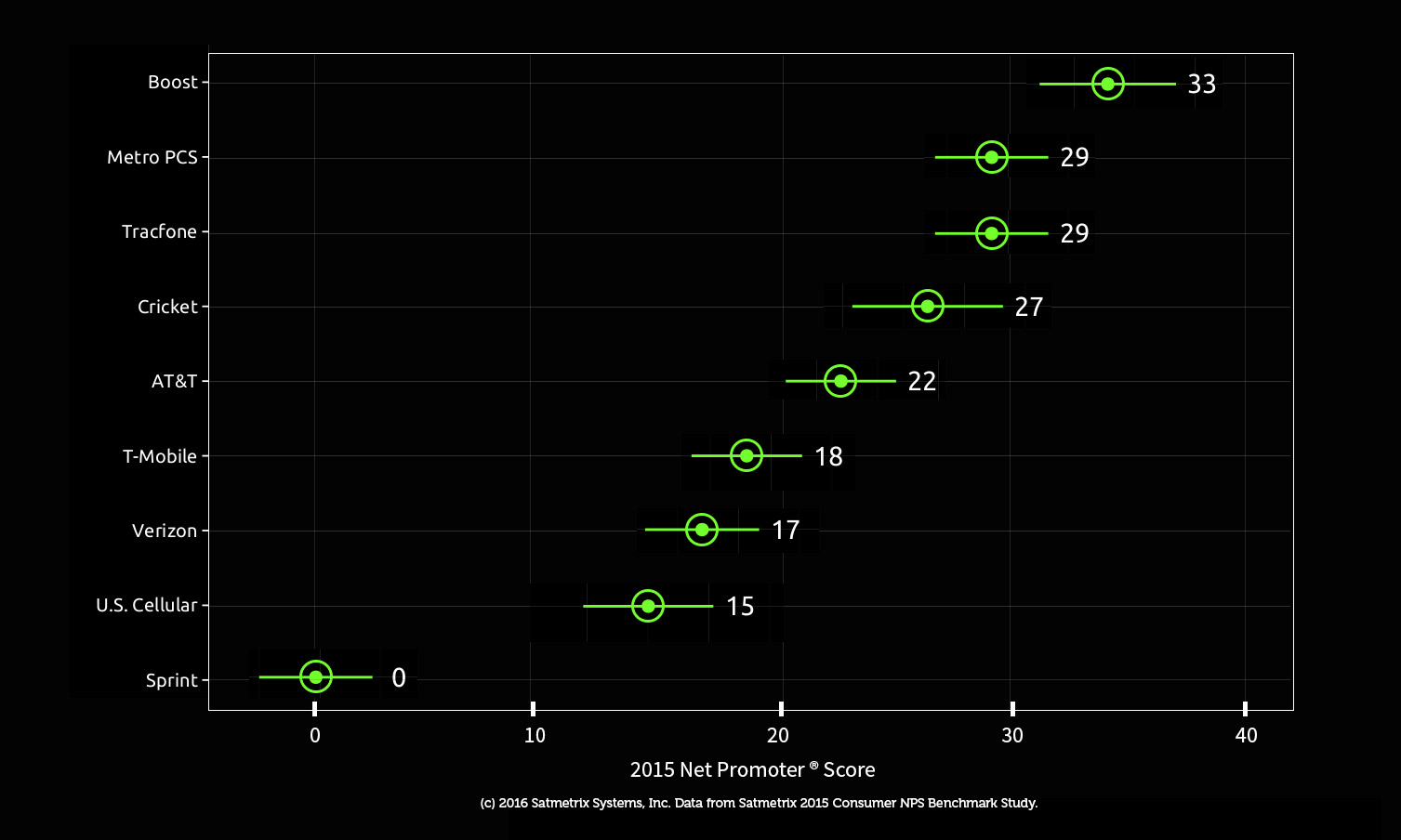

A great example of this is the cellular service market, traditionally dominated by a handful of companies enthusiastically pushing complex, long-term contracts. In the US, the cell service provider at the top of the table is Boost mobile, with an NPS of 33. Boost focuses are focused on providing flexible, low-commitment service bundles which reflect modern usage.

By contrast, at the very bottom of the cellular rankings is Sprint, with an NPS of 0. In the eyes of their respective customers, Boost outperforms Sprint on almost every measure, including satisfaction with network coverage. This is especially interesting as Boost is in fact a wholly owned subsidiary of Sprint, using exactly the same infrastructure.

We’ve seen similar things in our UK study too. Tesco Mobile’s no-nonsense brand has a significantly higher NPS than 02, from who they white-label the entire service.

Banks Can Play, Too

It’s not just cellular service. The highest NPS across the UK study comes from First Direct, with a mightily impressive score of 73. The Internet bank has long made its expectations about retaining customers explicit, with offers of free cash to defect from another brand, and has offset its lack of branches with investments in onshore call centers, and online tools. All of this loyalty is built on top of the financial infrastructure of its parent company, HSBC — which has a substantially lower NPS of just 12.

So, are your customers responding to your service, or to your positioning?